How to Buy Stocks, Investing in stocks is a key component of any well-rounded investment portfolio. Over the past century, stocks have proven their worth, offering impressive annual returns, which is why learning how to buy stocks is an essential skill for any investor. According to Vanguard, a 100% stock portfolio delivered an average annual return of 12.3% between 1926 and 2021, almost double the return of an all-bond portfolio during the same period.

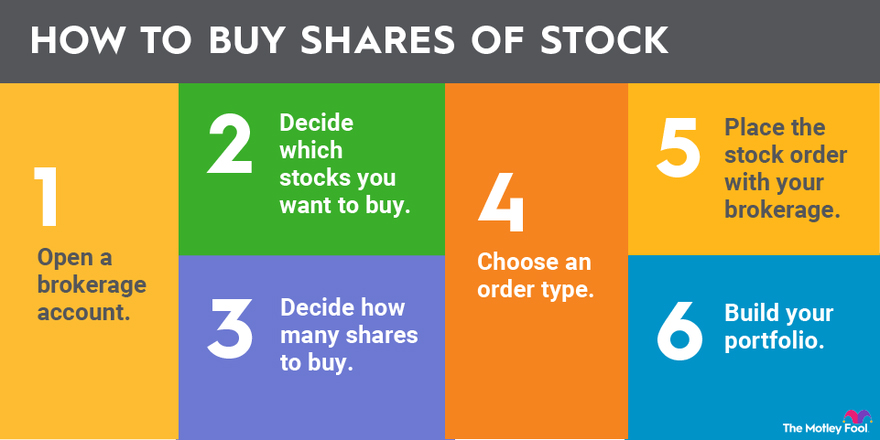

Here’s a step-by-step guide on how to buy stocks:

- Open an Online Brokerage Account

Opening an online brokerage account is the most convenient way to buy stocks. If you enjoy researching companies and diving into market trends, an online brokerage is an excellent place to start your stock investment journey. Online brokerages offer both taxable and tax-advantaged accounts. If you’re planning for retirement, an Individual Retirement Account (IRA) provides tax advantages such as tax-deferred growth and potential tax credits.

For investors seeking to buy stocks for goals other than retirement or who have maximized their retirement contributions, a taxable brokerage account is a flexible option with no contribution limits. Some brokerages might also offer margin accounts, which allow you to borrow money to buy stocks, increasing your potential returns but also your risk.

- Direct Stock Purchase Plans

Consider direct stock purchase plans if you’ve already identified specific stocks you want to buy. Not all publicly traded companies offer these plans, but many well-known companies do. Unlike brokerage accounts, direct purchase plans don’t require a brokerage intermediary, but they may involve additional fees. These plans are typically administered by third parties like ComputerShare and American Stock Transfer & Trust Company (AST). It’s essential to evaluate the benefits of using direct stock purchase plans, as they may charge fees and offer less flexibility compared to online brokerages. - Full-Service Brokerages

Full-service brokers provide a wide range of financial services, from retirement planning to estate planning, in addition to helping you buy stocks. However, their services come at a premium, as they charge higher commissions compared to online brokerages. Full-service brokers are an excellent choice for individuals with substantial assets looking for comprehensive financial management. If your primary goal is buying stocks, a direct purchase plan or an online brokerage might be a more cost-effective option.

- Robo-Advisors

Robo-advisors are automated investing platforms that create a diversified portfolio of exchange-traded funds based on your financial goals, investment horizon, and risk tolerance. While robo-advisors offer a hands-off approach to investing, they differ from directly buying individual stocks. Robo-advisors focus on constructing portfolios rather than selecting individual stocks. They can be an ideal choice for investors who prefer a more hands-off approach to investing. - Research and Select Stocks

Choosing the right stocks to buy can be a challenging task given the numerous options available. You can approach stock selection with various strategies:

Growth Stocks: These are shares of companies experiencing rapid profit or revenue growth, often younger companies with substantial room for expansion. Investing in growth stocks can yield substantial long-term gains but may involve short-term volatility.

Value Stocks: Value stocks are shares of companies trading at a discount compared to their intrinsic value. They are typically characterized by low price-to-earnings and price-to-book ratios. The goal is to buy undervalued stocks and hold them for the long term.

Dividend Stocks: Dividend stocks distribute earnings to shareholders as dividends, providing a steady income stream. Investing in dividend stocks is ideal for income-oriented investors. Sectors like utilities and telecommunications often offer dividend-paying stocks.

- Use a Stock Screener

To narrow down your list of potential stocks to buy, consider using a stock screener. Stock screeners allow you to apply filters and criteria to find stocks that match your investment objectives. Most online brokerage accounts provide stock screeners, and there are also free versions available online. These tools enable you to filter stocks by market capitalization, price, industry, P/E ratio, and other key indicators. - Execute Your Stock Trades

After funding your brokerage account and selecting the stocks you want to buy, it’s time to execute your trades. It’s crucial to understand the types of orders and how they work when purchasing stocks.

Market Order: A market order instructs your broker to buy a stock immediately at the prevailing market price. Keep in mind that the market price may vary slightly from what you initially see due to rapid price changes.

Limit Order: With a limit order, you specify the price at which you want to buy a stock. The order is executed if the stock’s price reaches or drops below the limit within a designated time frame. If the price doesn’t reach the specified level, the order is canceled.

For those with a limited account balance and high-priced stocks in mind, fractional shares are an option. Brokerages like Charles Schwab, Fidelity, and Robinhood offer fractional shares, allowing you to invest even with a small budget.

- Utilize Dollar-Cost Averaging

Stock prices are constantly fluctuating, making it challenging to time your purchases perfectly. Dollar-cost averaging addresses this issue by investing a fixed amount of money at regular intervals, potentially reducing your average cost per share over time. This approach lets you start investing with a modest sum, helping to spread your purchases over an extended period and mitigate the risk of buying at a high price. - Strategically Plan Your Stock Sales

Determining when to sell your stocks should align with your financial goals and timelines. Long-term investors should develop a strategy based on their objectives. Day-to-day market fluctuations are typically irrelevant for long-term investors.

Consider these factors when deciding to sell:

Financial Goals: Sell stocks when you need the money to meet your financial goals.

Reevaluate Your Portfolio: If you’re contemplating selling a stock due to a decline in its price, assess whether the company’s fundamentals have changed.

Tax Implications: Understand the tax consequences of selling stocks, particularly capital gains tax. The tax rate may vary depending on the holding period of the stock.

Selling stocks to offset capital gains or losses in your portfolio is a tax-efficient strategy. Keep in mind the wash-sale rule, which prohibits buying back the same or substantially identical stocks within 30 days after selling them at a loss.

Learning how to buy stocks is the foundation of building a robust investment portfolio. By following these steps and conducting thorough research, you can embark on your journey as a savvy stock investor

2 thoughts on “How to Buy Stocks: Mastering the Art of Smart Investments”